Sneddon sets us thinking: STA firm favourite

We welcomed back to our monthly meeting one of our members’ favourite speakers: David Sneddon, MD global strategy TA at Credit Suisse in London where he has been working for about twenty years – technical analysis is really his life’s work.

A maths graduate whose Dad was a keen private investor, when working at a fund manager’s office he asked the traders to tell him more about how they chose their investments. Unlike his father who was a value and fundamentals man, many used charts focusing not on the ‘why’ of moves but whether they were relevant and worth trading. He ‘got’ it at once and hasn’t looked back.

A maths graduate whose Dad was a keen private investor, when working at a fund manager’s office he asked the traders to tell him more about how they chose their investments. Unlike his father who was a value and fundamentals man, many used charts focusing not on the ‘why’ of moves but whether they were relevant and worth trading. He ‘got’ it at once and hasn’t looked back.

The core of his role at the bank is to generate trading ideas where sitting on risk committees gives him a key role in assessing opportunities. He believes the financial world changed dramatically because of the financial crisis in 2007-2009 and that even the most fundamentally minded of shops realised that technical analysis was an essential to a decent ‘toolkit’.

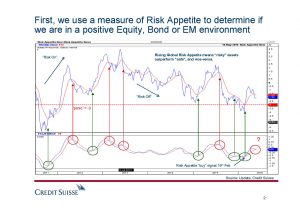

Starting with a proprietary risk asset tool designed by his colleagues, he overlays some fundamental data to see if these confirm the technicals in the background (until this point). Then he goes about seeing if and how different asset classes correlate before finally having a good look at the charts using classical Dow Theory.

With no set roadmap his aim is to get probable outcomes aligned in his favour which, coupled with a rigorous use of stop loss levels (because these make the biggest difference to profit and loss) gives the traders an edge.

The myriad charts he brought for this presentation ought to be scrutinised as they hold a wealth of information and are specific to the industry. Watch and pause the video of his presentation when it is released on the STA website.

Finally, he told us about the TINA trade. Thinking it might be modern dealing room banter relating to teenagers and Millennials, or someone’s wife, I was so off-piste it was pathetic. It is simply: There Is No Alternative.

Tags: correlation, Fundamentals, macro, risk appetite

The views and opinions expressed on the STA’s blog do not necessarily represent those of the Society of Technical Analysts (the “STA”), or of any officer, director or member of the STA. The STA makes no representations as to the accuracy, completeness, or reliability of any information on the blog or found by following any link on blog, and none of the STA, STA Administrative Services or any current or past executive board members are liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. None of the information on the STA’s blog constitutes investment advice.

Latest Posts

- The High-Performance Trader Learning Programme: Elevating Trading Excellence December 13, 2024

- Developments in Technical Analysis: Incremental improvements November 27, 2024

- Seasonality, Cyclicals and Statistics: Probability rules! November 13, 2024

- Atlas of Finance: Mapping the Global Story of Money November 5, 2024

- Have Central Banks tamed inflation? Or are they to blame for the whole fiasco? October 23, 2024

Latest Comments