January is a long month: Its tempting to wish it away

Despite New Year festivities in the majority of countries which follow the Gregorian calendar, and Lunar New Year which this year started on 22nd January and causes the biggest annual mass migration (China), plus the easing of travel restrictions as we learn to live with Covid, January can be cruel. In the Northern hemisphere days are short, though lengthening, nasty spells of freezing weather can spring up too, and this year Alpine ski resorts have precious little snow to attract tourists. Not only do we have to endure 31 days of this month, many people are short of cash and wondering whether they’ll get through to the next pay check.

As a technical analysts I’m egging my charts on, hoping they’ll give me a steer as to what I might expect over this quarter or six months. As consensus opinion for this year’s outlook veers unexpectedly, a cool head and cold heart are needed more than ever.

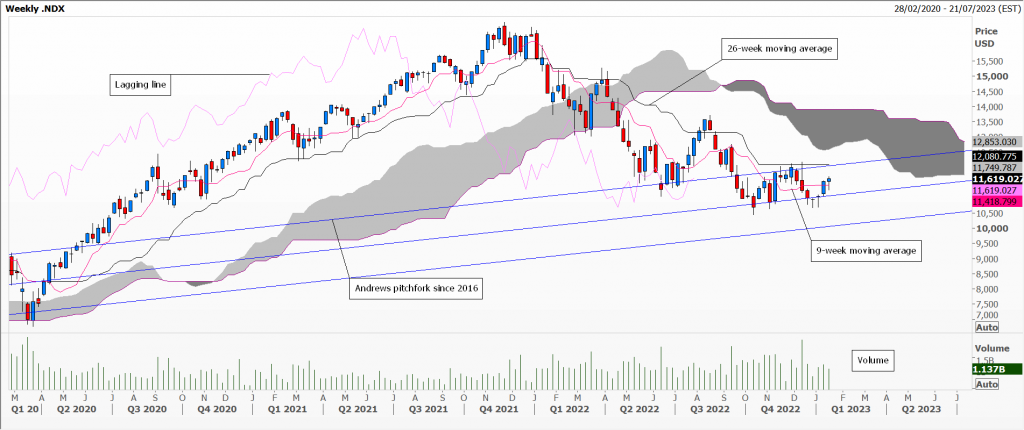

So to the NASDAQ, where yet another mega-tech firm has announced massive job cuts, blaming excessive pandemic-related hiring. Yeah, right. The weekly Ichimoku cloud chart attached to this piece shows all aspects in a clear bear trend, as they have been for most of the last year. Volume was surprisingly strong in December, suggesting many are coming round to this idea – or slashing losing trades. We are now back inside an Andrews pitchfork (drawn from the 2016 lows, illustrating the increased rate of change in 2020/2021), its central tine is providing support. So, currently a holding pattern.

Next I look to the candles to see if they have anything to say for themselves. Precious little, I’m afraid, and I know that I must wait until the close of business Tuesday week for my monthly candles to complete. Friday’s close just above the 9-week moving average is hardly inspiring. Oh dear!

NASDAQ

Tags: Andrews Pitchfork, Ichimoku Clouds, moving averages

The views and opinions expressed on the STA’s blog do not necessarily represent those of the Society of Technical Analysts (the “STA”), or of any officer, director or member of the STA. The STA makes no representations as to the accuracy, completeness, or reliability of any information on the blog or found by following any link on blog, and none of the STA, STA Administrative Services or any current or past executive board members are liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. None of the information on the STA’s blog constitutes investment advice.

Latest Posts

- The High-Performance Trader Learning Programme: Elevating Trading Excellence December 13, 2024

- Developments in Technical Analysis: Incremental improvements November 27, 2024

- Seasonality, Cyclicals and Statistics: Probability rules! November 13, 2024

- Atlas of Finance: Mapping the Global Story of Money November 5, 2024

- Have Central Banks tamed inflation? Or are they to blame for the whole fiasco? October 23, 2024

Latest Comments