A blast from the past: Bubbles, baths and blood

Founder member of the STA Philip Gray treated us to a no-holds-barred look into manias and the madness of crowds last night. Warning us: ‘this lecture will seriously damage your wealth’ he regaled us with interesting, and many hilarious anecdotes of the bubbles he’s seen and the lessons he’s learnt.

Founder member of the STA Philip Gray treated us to a no-holds-barred look into manias and the madness of crowds last night. Warning us: ‘this lecture will seriously damage your wealth’ he regaled us with interesting, and many hilarious anecdotes of the bubbles he’s seen and the lessons he’s learnt.

Fabulous slides to accompany his not exactly politically correct delivery, he was unable to use them all and so has promised to let the STA put the pdf of the complete PowerPoint presentation on our web site. This way you will be able to scroll through his charts and cartoons at your leisure.

As a director of stockbroker James Capel in the mid-1990’s his focus was very much on share prices. Funding his higher education and expensive divorce with his trading proceeds he started out in London’s swinging sixties selling old share certificates from a stall in Portobello market.

Reminding us that bubbles are as regular as clockwork, often kicked off by deregulation and subject to international propagation, that no one learns fro m history and the phrase ‘paradigm shift’ is a red rag to the unwary, he is convinced that the most fun to be had in a bubble is during the last three months.

m history and the phrase ‘paradigm shift’ is a red rag to the unwary, he is convinced that the most fun to be had in a bubble is during the last three months.

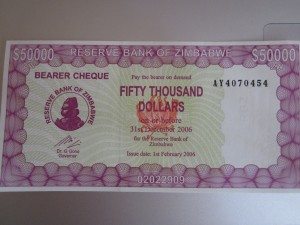

When gremlins got into his computer he paused and in an act of extreme generosity doled out fifty thousand dollar bills to keep the audience entertained – clue: a picture of the Victoria falls was on the back.

Timing the start of the crash is the problem, but he ran us through a series of events that usually lead to the bust. These include, often in this order, settlement failures, fraud, interest rate hikes, bank and corporate insolvency, direct intervention by the authorities and finally rule changes.

Tags: Bubbles, overvaluation, volatility

The views and opinions expressed on the STA’s blog do not necessarily represent those of the Society of Technical Analysts (the “STA”), or of any officer, director or member of the STA. The STA makes no representations as to the accuracy, completeness, or reliability of any information on the blog or found by following any link on blog, and none of the STA, STA Administrative Services or any current or past executive board members are liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. None of the information on the STA’s blog constitutes investment advice.

Latest Posts

- Navigating the Market: Insights from Robin Griffiths and Ron William April 9, 2025

- Avoid Revenge Trading: The Key to Long-Term Trading Success March 31, 2025

- Mastering Relative Strength Portfolios: Key Takeaways from the March STA Meeting March 12, 2025

- Stay Disciplined, Stay Profitable February 26, 2025

- Understanding Price Gaps in Trending February 19, 2025

Latest Comments