Bank underground: An STA shortcut?

Not the quickest route to the STA’s monthly meeting but the Bank of England’s blog for staff to share views. http://bankunderground.co.uk/

When Dan Nixon of the Stakeholders Communications & Strategy division writes thus:

Economic theory generally assumes that more consumption means greater happiness. This post puts forward an alternative, “less is more” perspective based around the concept of mindfulness. It argues that we may achieve greater happiness by seeking to simplify our desires, rather than satisfy them. The result – less consumption but greater wellbeing – could be especially important for debates around secular stagnation and ecological sustainability. (Full text http://bankunderground.co.uk/2016/04/25/less-is-more-what-does-mindfulness-mean-for-economics/ )

It’s time to sit up and listen. Obviously this will have an effect on how we choose to spend the money we have, and therefore have a huge impact on the economy generally – and for a very long time.

This lifestyle choice is one of many, where the most important for economic modelling is whether we choose to have children or not. For government spending and tax receipts, education and pension planning, it’s equally crucial yet the effects of this have not even begun to be properly factored in.

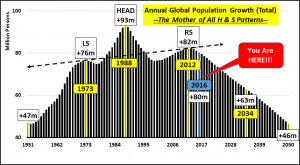

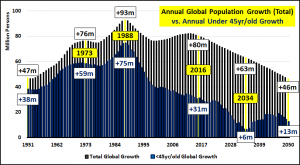

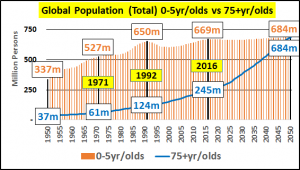

And even if considered, the seismic slide of demographics might be far too powerful for any attempt at slowing the impact. We present three charts that need little explanation. Please ignore the spurious (and incorrect) labelling of a head and shoulders top in the first one. Also remember that all three contain a good two-plus decades of estimated data from the OECD.

I’m sure you will agree that since 1988 we have a shrinking and ageing population, and that the ratio of the very young to the really old looks set to narrow dramatically over the next 25 years.

Perhaps we shall all have to tighten our belts and embrace an ascetic Buddhist philosophy – like it or not.

Tags: ageing, Austerity, Bank of England, demographics

The views and opinions expressed on the STA’s blog do not necessarily represent those of the Society of Technical Analysts (the “STA”), or of any officer, director or member of the STA. The STA makes no representations as to the accuracy, completeness, or reliability of any information on the blog or found by following any link on blog, and none of the STA, STA Administrative Services or any current or past executive board members are liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. None of the information on the STA’s blog constitutes investment advice.

Latest Posts

- Mastering Relative Strength Portfolios: Key Takeaways from the March STA Meeting March 12, 2025

- Stay Disciplined, Stay Profitable February 26, 2025

- Understanding Price Gaps in Trending February 19, 2025

- Key Takeaways from a Fireside Chat with Perry Kaufman February 12, 2025

- The Power of Patience: How Waiting for the Right Setups Can Make or Break Your Trading Success February 3, 2025

Latest Comments