Bond Vigilantes Front and Centre: August can be such a cruel month

Paraphrasing T. S. Eliot’s lines from The Wasteland: ‘April is the cruellest month, breeding lilacs out of the dead land, mixing memory and desire, stirring dull roots with spring rain’. The poet believed the season gave false hope of what was to come. Well, so far this month stock market investors have been on an especially wild ride, and I’m afraid August isn’t over yet.

Note that the media and stockbrokers have a bias towards covering equities because, as my favourite technical analysts David Fuller used to say: ‘’it’s so much easier to tell fairy stories with these.’’ Cash and fixed income markets are all about arithmetic; nothing too, too fancy requiring further maths, mind you. Perhaps what with one thing and another investors have decided to sharpen their pencils and do quick calculations on the back of an envelope.

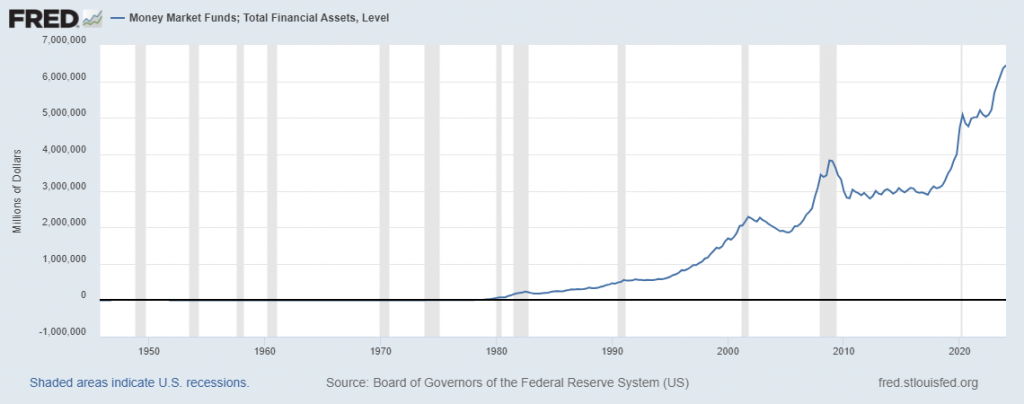

US money market funds, which took off in the 1980s era of very high inflation, have seen holdings soar to US$6,440,699 million dollars so far this year, according to the Saint Louis Fed. Simple to understand and to buy and sell.

The Association of British Insurers reports that in 2023 annuity sales are up 46 per cent over 2022, running at £3.6 billion in the first half of 2024. For illustrative purposes the Retirement Line website states that £100,000 will buy an annual income of £7554 on a single life aged 65. That’s a yield of about 7.55 per cent. Go figure why they are in demand after a decade of zero interest rate policy.

The Financial Times’ respected Robin Wrigglesworth reports that in the US exchange traded bond fund sales are soaring. First launched by iShares in November 2020, assets under management in this class are about US$ 2.2 trillion this year.

The (US) Securities Industry and Financial Market Association [SIFMA} publishes monthly data on US Treasuries, corporate and municipal bonds, federal agency and asset backed securities. In July issuance of these totalled $6,018 billion; trading volumes were $1,242 billion; amounts outstanding totalled $52.9 trillion. Obviously lots of ‘buy and hold’ merchants.

Perhaps it might be your turn to look into this area of finance. To make the exercise a little more interesting I attach a podcast my daughter sent me. It’s a light-hearted look at Jim Leaviss’ 30-years’ work in the bond markets, first at the Bank of England, then as CIO of M&G Investments where his team are known as the ‘bond vigilantes’. With the FT’s Katie Martin the two even think back to 1990s pop music. https://on.ft.com/4dByxOZ

Tags: annuity, bonds, Cash, income stream, yield

The views and opinions expressed on the STA’s blog do not necessarily represent those of the Society of Technical Analysts (the “STA”), or of any officer, director or member of the STA. The STA makes no representations as to the accuracy, completeness, or reliability of any information on the blog or found by following any link on blog, and none of the STA, STA Administrative Services or any current or past executive board members are liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. None of the information on the STA’s blog constitutes investment advice.

Latest Posts

- Trade with a Plan: The Key to Consistent Success October 28, 2025

- Trust Me, I’m a Technical Analyst by Trevor Neil: Why Charting Is as Important Now as Ever October 15, 2025

- Why Networking Still Matters: Reflections from the STA Drinks at the National Liberal Club October 2, 2025

- Fireside Wisdom: Clive Lambert in Conversation with Tony LaPorta September 10, 2025

- Understanding Triple RSI Divergence: A Potential Warning Sign for the S&P 500 September 1, 2025

Latest Comments