Graphing vibration and its varients: Sound waves being just one of many

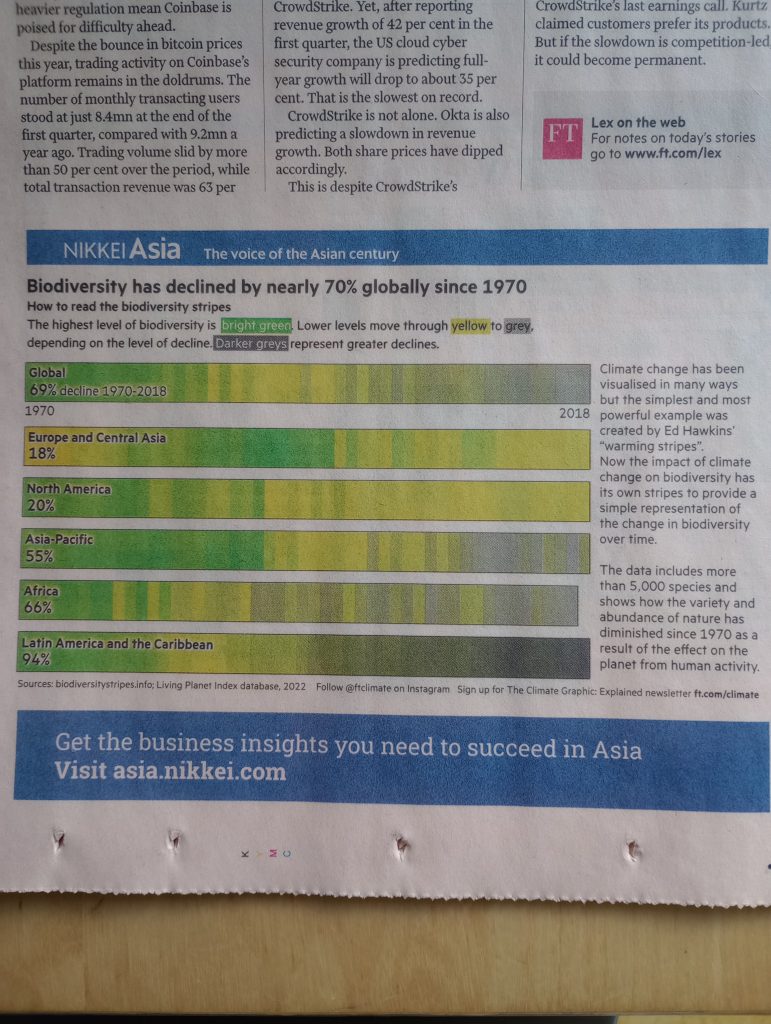

Take a close look at my first chart, initially published in the Weekend FT a few weeks ago. It plots the – by now almost inevitable – decline in the biodiversity of the five major continents with the global average at the top. Data from 1970 to 2018 (latest available), shows a general decline over the last half-century, Europe and Central Asia being something of an outlier, Latin America and the Caribbean the sorriest specimen.

I’m not going all green on you here, but pointing out how this type of info-graphic might be of use to technical analysts. You will have come across something similar already, be it visualisations of sound waves, mixing desks used by sound engineers to smooth and splice voices, and even electrocardiograms used by medics.

Technical analysts have a version of these horizontal charts, Market Profile, perhaps the best known. Originally devised by Chicago futures traders, and therefore divided into the half-hour (alphabetically labelled) segments of the trading pits, these are excellent in giving a feel for volume at price.

Some might feel that Elliott Wave theory bears similarities with its focus on waves and their natural progression. Someone who has taken this concept to a far higher level is Tony Plummer FSTA where his in-depth study of the work of W D Gann led him to write ‘The Law of Vibration: The Revelation of William D. Gann’.

This book, which has formed the basis of a superb presentation he gave to the STA some years ago, is another in a list of books, research papers and texts he’s written over his long career in the City of London. It follows on from his 1989 ‘Forecasting Financial Markets – The psychology of successful Investing’. Here he analyses the mind as a dynamic principle, differentiating between the thinking of the individual and that of a crowd.

STA members can view a video of the presentation via our website www.technicalanalysts.com (9 April 2013) which is introduced thus:

‘The book has been more than 20 years in the making, and it reveals the extraordinary pattern of oscillation that Mr Gann hid in “The Tunnel Thru The Air”. The pattern has a long – and secret – history, and is central to a general ‘law’ of vibration that may well permeate the universe. This law directs the processes of change in collective human behaviour and can be used to anticipate movements in financial markets, to forecast trends in economic activity, and to judge the validity (or otherwise) of economic policy initiatives. The pattern associated with the law of vibration is objective, verifiable, and accurate. It validates the assumptions that underlie technical analysis and it is likely to find applications in a whole range of scientific disciplines.’

The views and opinions expressed on the STA’s blog do not necessarily represent those of the Society of Technical Analysts (the “STA”), or of any officer, director or member of the STA. The STA makes no representations as to the accuracy, completeness, or reliability of any information on the blog or found by following any link on blog, and none of the STA, STA Administrative Services or any current or past executive board members are liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. None of the information on the STA’s blog constitutes investment advice.

Latest Posts

- Navigating the Market: Insights from Robin Griffiths and Ron William April 9, 2025

- Avoid Revenge Trading: The Key to Long-Term Trading Success March 31, 2025

- Mastering Relative Strength Portfolios: Key Takeaways from the March STA Meeting March 12, 2025

- Stay Disciplined, Stay Profitable February 26, 2025

- Understanding Price Gaps in Trending February 19, 2025

Latest Comments