Interest rates on the up: That old chestnut

At the start of another calendar year we have been warned that developed world interest rates can only go up. Yes, again! Just as they have been threatening for the best part of a decade; just because rates were at record or rock bottom lows; and was it last year or 2015 that every single professional pundit polled by Bloomberg believed that US Treasury yields were definitely going up?

Even if you haven’t given up on consensus thinking and turned contrarian, you might be surprised to hear that the same news vendor was peddling the same story towards the end of last year. Bloomberg View said on the 15th November 2016: ‘government bonds have changed course. Prices are falling, yields are rising, and market commentators are scrambling to make sense of the change in environment’. Not sure about last bit though…

https://www.bloomberg.com/view/articles/2016-11-15/the-bond-vigilantes-are-back-in-the-saddle

They then go on to state that ‘the violence of the move in the past few days, where the surge in the 30-year US Treasury yield climbed above 3 per cent, is mathematically a move of more than 2 standard deviations’. From a record low at 2.10 per cent in July last year the yield backed up, in three stages (A, B, C-type correction?) to blip just over 3.00 per cent, and stopped.

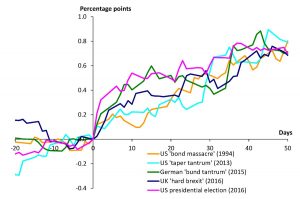

Fast forward to 16 February 2017 and the Bank of England published research on previous back-ups in bond yields.

https://bankunderground.co.uk/2017/02/17/bitesize-tantrums-massacres-and-bond-market-reversals/

Comparing 10-year German, UK and US Treasury yields in five different periods we can see that the rate reversal on all was about 80 basis points over 50 days – and that this time is no different.

What we must remember is that very small numbers behave differently from bigger and giant ones. So yields on 10-year Japanese Government Bonds can easily double or treble if you start at just 7 basis points. So too German and Swiss short-dated paper. And as for negative yielding ones, these are even trickier to compute.

Keeping a sense of perspective is key.

Tags: consensus thinking, correction, Yields

The views and opinions expressed on the STA’s blog do not necessarily represent those of the Society of Technical Analysts (the “STA”), or of any officer, director or member of the STA. The STA makes no representations as to the accuracy, completeness, or reliability of any information on the blog or found by following any link on blog, and none of the STA, STA Administrative Services or any current or past executive board members are liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. None of the information on the STA’s blog constitutes investment advice.

Latest Posts

- Navigating the Market: Insights from Robin Griffiths and Ron William April 9, 2025

- Avoid Revenge Trading: The Key to Long-Term Trading Success March 31, 2025

- Mastering Relative Strength Portfolios: Key Takeaways from the March STA Meeting March 12, 2025

- Stay Disciplined, Stay Profitable February 26, 2025

- Understanding Price Gaps in Trending February 19, 2025

Latest Comments