Long nights and long term forecasts: Winter in the Northern hemisphere

For weeks now sundry pundits, economists and technical analysts have been laying out their plans and predictions for the year 2023 – and some dare go beyond that. I suppose the best that might be said is that the huge tomes produced give us something to read as we approach the winter solstice when there is little daylight and a series of long cold nights to ‘look forward’ to.

I’ve noticed that increasingly over the last decade or so they give their main view, often called their ‘base case scenario’, followed by a more optimistic one and a less favourable one. This obviously increases their chances that one of their three dart-throwing exercises comes right.

Now there’s a fourth option, one which I’d describe as a totally unexpected and unpredictable occurrence; this has perhaps cropped up as a result of 2020’s pandemic. Interestingly this concept was first pioneered by Steen Jacobsen of Saxo who used to publish an amusing list at Christmas of the most unlikely market and economic outcomes he could think of.

Early this November Katie Martin in FT Weekend noted that renown US stock market bear at Morgan Stanley, Michael Wilson, had ‘’two weeks ago turned tactically bullish on US equities. Some investors felt this call came out of left field…[but] was based almost entirely on technicals rather than fundamentals.’’ Explaining that ‘’oddities’’ and chart patterns were ‘’too much to ignore’’, he appears to be yet another chief equity strategist hedging his bets.

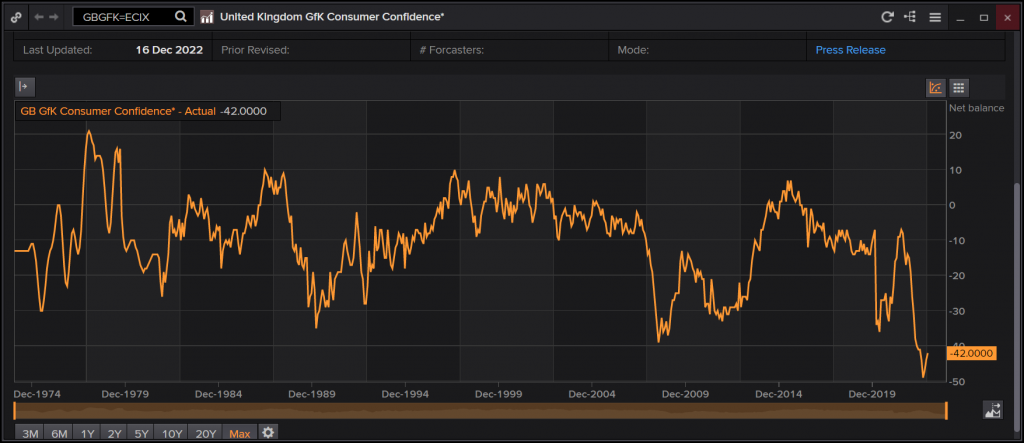

Below I give you a graph of UK consumer confidence up to the 11th November 2022, a data series which contains many of the elements forecasters are currently grappling with. A survey carried out by GfK (which stands for Growth from Knowledge, by the way) since January 1974, the readings as of April this year are the weakest in the series, meaning that so far for this tax year we are at record lows. Bleak indeed.

Tags: forecasts, Outlook, seasonals

The views and opinions expressed on the STA’s blog do not necessarily represent those of the Society of Technical Analysts (the “STA”), or of any officer, director or member of the STA. The STA makes no representations as to the accuracy, completeness, or reliability of any information on the blog or found by following any link on blog, and none of the STA, STA Administrative Services or any current or past executive board members are liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. None of the information on the STA’s blog constitutes investment advice.

Latest Posts

- Navigating the Market: Insights from Robin Griffiths and Ron William April 9, 2025

- Avoid Revenge Trading: The Key to Long-Term Trading Success March 31, 2025

- Mastering Relative Strength Portfolios: Key Takeaways from the March STA Meeting March 12, 2025

- Stay Disciplined, Stay Profitable February 26, 2025

- Understanding Price Gaps in Trending February 19, 2025

Latest Comments